Elevate Your Fraud Prevention Strategy

Integrate seamlessly with your existing LOS and get up and running up to 30% faster with Zoot’s application fraud system, built to enable confident approvals while driving down risk.

Test various fraud-fighting strategies, compare and test a variety of data providers for optimal outcomes, and adapt to emerging fraud trends with best in class data providers already integrated.

With multiple fraud stages and orchestration types at your disposal, gain visibility into common fraud occurrences and leverage valuable insights to refine your long-term strategy.

Enhance Fraud Protection

Stay ahead of hidden threats with a proactive, multi-layered approach to detecting, preventing, and mitigating fraud.

Experience Seamless Integration

Integrate with your existing loan origination system and data providers for a streamlined experience.

Minimize Costs & Fees

Minimize unnecessary spending with multiple orchestration types and increased control over data provider calls.

Leverage Automation for Smarter Fraud Defense

70% of banks and credit unions are experiencing increased fraud losses. Leverage advanced data orchestration to identify trends and ensure confidence in every outcome.

Zoot’s base application fraud system comes ready-made with four fraud stages and three orchestration types, each with a decision step that determines whether the flow will continue or if adequate data has been received.

Stay ahead of trends with the ability to analyze newly occurring types of fraud, see where in the process they most often occur, and adapt quickly with a system built for flexibility.

Meeting Your Needs, and Exceeding Your Goals

Zoot offers a range of ready-made and fully tailored application fraud systems designed to streamline processes and drive better outcomes. Whatever your needs, we have the perfect fit for you.Base Application Fraud System

Industry Leading Technology:

2-6 Week Implementation* Flexible Platform Grows with YouSingle API Connection

- Full Integration with Existing Loan Origination System

The Essential Tools to Drive Profitable Growth:

- Four Fraud Stages

- Three Orchestration Types

- Integrated Data Providers

- Audit Viewer

- Champion-Challenger Testing

Professional Application Fraud System

Everything You Need from Base:

- Industry Leading Technology

- Flexible Platform Grows with You

- Single API Connection

- Four Fraud Stages

- Three Orchestration Types

Plus the Right Additions to Level-Up Your Fraud Prevention Program:

- Fully Customizable Rules & Logic

- Additional Fraud Stages

- Ability to Integrate Any Data

- 24 / 7 / 365 Platform Monitoring & Support

Elite Application Fraud System

Guidance & Support for Any Project:

Our Elite credit application fraud system empowers financial institutions with a robust, customizable platform designed to meet the demands of modern application fraud prevention. From tailored product development to scaled agile delivery, we partner with your team to co-develop or fully engineer solutions that match your vision.Your Ideas Put Into Action

- Consultative Approach

- Enterprise-Wide Capable

- Future-Ready, Scalable Platforms

Schedule a Consultation

Explore Zoot’s Capabilities or schedule a consultation with our team to learn how our application fraud system can make an impact at your organization.

Mitigate Risk through Advanced Orchestration

Save as much as 20% in fees via least cost routing, only calling data providers when necessary to get the full picture of each applicant based on your risk thresholds.

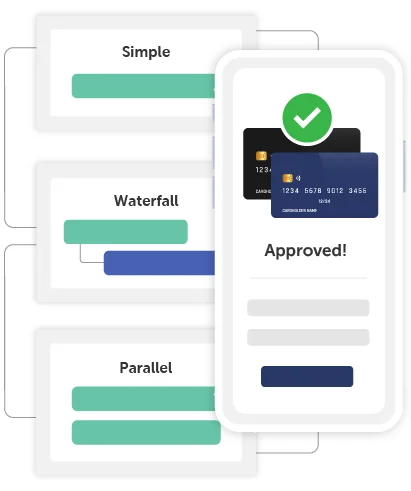

Zoot’s base system includes three orchestration types – Simple, Waterfall, and Parallel – enabling you to compare data providers, call multiple providers (in sequence or simultaneously), and ensure you get the data you need in case of a data provider outage.

And, with Champion/Challenger functionality, you can easily compare data providers and flows to identify those that will best meet your needs and mitigate risk at your business.

Powering Success, Together

Every business is unique, and so are your challenges. Get up and running fast with an application fraud system tailored to your needs.

With Zoot, banks and credit unions gain a trusted partner that delivers stability, flexibility, and unmatched processing power. Backed by decades of experience, our team of experts will help you identify the right fit for your organization and guide you through implementation.

Whether off-the-shelf or custom, real humans provide worldwide support whenever you need us. We know a critical issue or setback never happens at a convenient time, which is why we’re in your corner from start to finish.

Fuel Success with the Right Data

Ensure confidence in every outcome with access to top-tier data providers within your application fraud system, whether enhancing risk assessment, streamlining approvals, or improving customer experiences.

Zoot’s application fraud system centralizes data, empowering analysts to drive smarter, faster decisions, and providing quicker responses to your customers by intelligently acquiring and orchestrating the right data at the right time.

Easily integrate with existing systems through Zoot’s API, simplifying communication while ensuring robust security.

Frequently Asked Questions

How long does it take to implement Zoot’s application fraud system?

Can Zoot’s application fraud system integrate with our existing systems?

Can Zoot’s application fraud system be used across multiple lines of business?

Ready to Take the First Step?

Explore Zoot’s Capabilities or schedule a consultation with our team to learn how our solutions can make an impact at your organization.Fraud Resources

Fireside Chat: Streamlining the Customer Experience with Equifax & Zoot

In today's fast-paced financial sector, accessing data is crucial, but integrating it effectively into decision-making is key to...

BNPL Lending: Trends, Risks, and How Lenders Can Stay Ahead

Buy Now, Pay Later (BNPL) has moved from a niche e-commerce feature to a defining force in consumer credit. Once dominated by fintech...

FinovateFall 2025: Recap & Key Takeaways

The energy at FinovateFall 2025 was unmatched, and Zoot was proud to be part of it. From meaningful conversations at our booth to...