Prequalification

Match Your Customers

with Ideal Products

Implement Zoot’s innovative prequalification solution tailored to banks, credit unions, and fintechs, enabling real-time assessment of customer information, accurately matching consumers with suitable offers, and increasing conversions without extending a firm credit offer, fostering business growth and customer satisfaction.

Give Customers Control

Improve approval rates, utilization, & product fit by giving consumers the ability to see the products they may qualify for, review features, & determine best fit before beginning the application process.

Generate Profitable Leads:

Match consumers to loan options when and where they are most likely to respond, whether via online or mobile banking applications, over the phone, or face-to-face.

Make Better Decisions

Gain access to data, attributes, scores, and more to improve decisions across the whole customer lifecycle, increasing qualification and approval rates while lowering operational and acquisition costs.

Overview & Key Benefits

Resources are drained quickly when you’re inundated with unqualified applicants. Stop wasting valuable time going after the wrong customers with the wrong offers.

Give already engaged consumers a compelling reason to start or deepen a relationship with your brand and leverage a powerful, consent-based tool to prequalify your ideal customers in real time without a firm offer of credit.

Zoot’s prequalification solution is your path to turning interested prospects into new customers. Put the consumer in the driver’s seat, showing them only viable options that will leave no negative impact on their credit while minimizing risk to your business and increasing ROI.

Quick Case Study

Crafting a Seamless End-to-End Experience

Tedious manual entry in separate underwriting and booking systems bogged down the productivity of the underwriting team at a regional bank. Upon updating their website, the team sought a solution that would seamlessly integrate and increase efficiency.

Zoot partnered with the bank to create a full end-to-end solution including consumer-facing web applications, a full decision engine complete with various bureau and third-party data, back office screens for manual review, and an automated process for approval and decline letters.

By partnering with Zoot, the bank experienced a major increase in productivity, reduction in manual errors, and provided both the customer and the underwriter with an improved experience, all while making offers of credit to the right customers faster.

Prequalification System Features

Streamline your credit evaluation process and expedite offer delivery with our intuitive interface and seamless integration. Empower your team to make quick decisions and enhance efficiency, reducing review time and accelerating the delivery of credit offers.

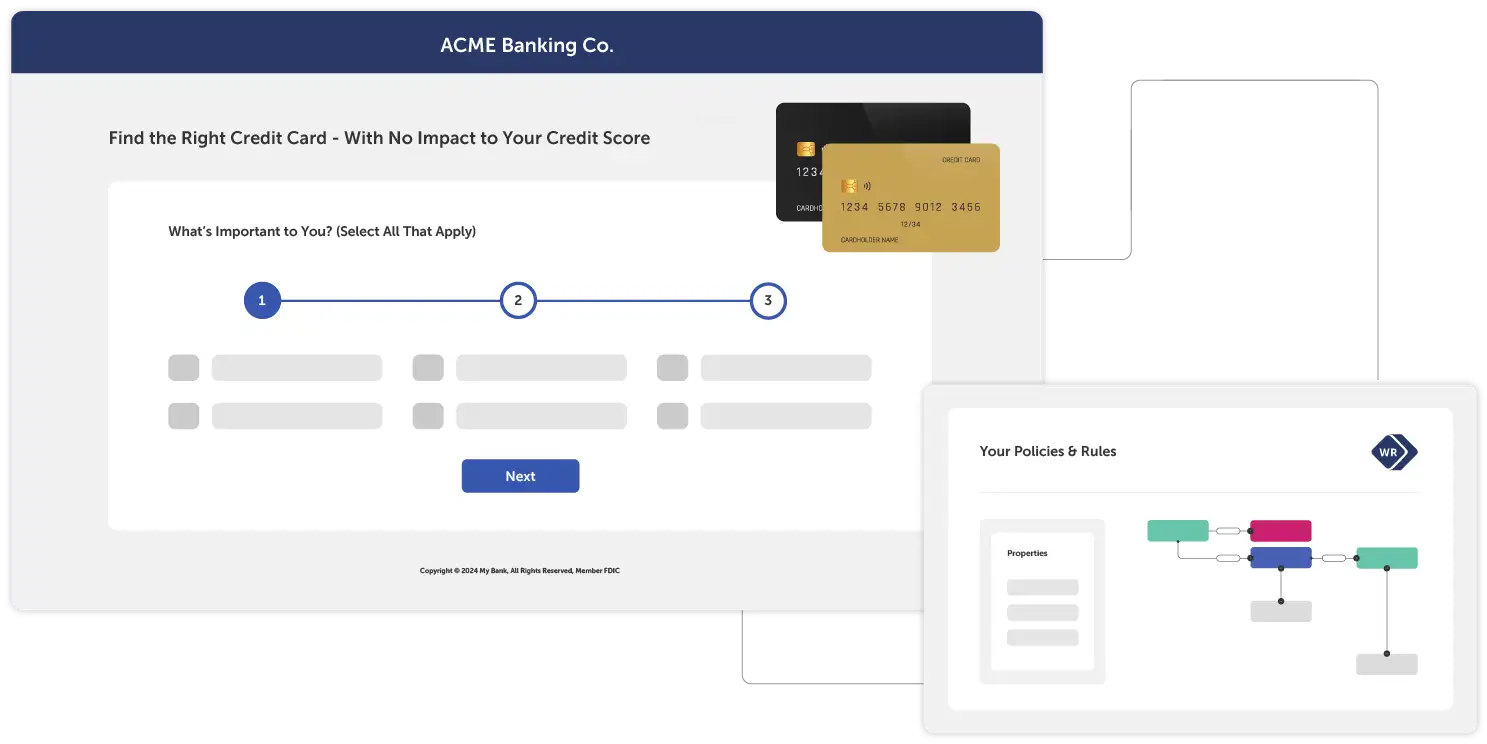

Fully Customizable Platform

Tailor Zoot’s prequal solution to meet your specific business needs, ensuring a seamless and personalized experience for your customers.

Consumer-Facing Application Screens

Engage and empower your customers with user-friendly and intuitive application screens, making the prequalification process effortless and enjoyable.

Back Office Underwriting Access

Gain comprehensive access to the underwriting process, allowing for efficient evaluation and decision-making, ultimately speeding up loan approvals.

Manually Work Applications to Completion

Have full control over the prequalification process by manually working through applications, ensuring accuracy and attention to detail.

Customizable Decision Rules

Set your own decision rules to automate loan approvals based on your unique business requirements, reducing manual intervention and increasing efficiency.

ID Verification

Safeguard against identity fraud and ensure the authenticity of applicants by seamlessly integrating ID verification tools into the prequalification system.

Fraud Detection

Mitigate the risk of fraudulent activities with robust fraud detection mechanisms, protecting your business and customers from potential financial harm.

Instant Decisioning

Provide real-time loan decisions to applicants, enhancing the customer experience and reducing wait times, resulting in higher satisfaction rates.

Powerful Integrations

Seamlessly integrate with external systems and service providers, allowing for smooth data exchange and enhancing the overall efficiency of the prequalification process.

Future-Ready Flexibility

Adapt to the evolving demands of the lending industry with a flexible prequalification system that can easily incorporate new technologies and regulatory changes.

Multiple User Groups & Roles

Assign different roles and access levels to various user groups, ensuring secure collaboration across teams and maintaining data integrity.

![]()

“Zoot’s solution provides access to some of the most predictive information available.”

Use Cases

Get the best end-to-end solution to drive profitable growth and support your specific lines of business, all while maintaining regulatory compliance, improving efficiency, and enhancing the customer experience.

Partners & Providers

Zoot’s partners and providers network offers clients access to an extensive global network of data and service providers, with pre-built connections to best-of-breed data sources. Our advanced capabilities enable swift integrations to new sources, providing seamless connectivity to advanced data, AI, and machine learning models. By leveraging this network, clients easily integrate high-quality data, make informed decisions, enhance risk management, and drive business growth.

Frequently Asked Questions

What is prequalification?

Prequalification is an innovative approach utilized by banks, credit unions, and fintech companies to provide consumers with valuable insights into the products they are eligible for. Through a seamless, consumer-initiated process, prequalification instantly determines creditworthiness at the point of contact. The unique aspect of prequalification is that it does not require the company to make a firm credit offer, allowing consumers to explore their options without any obligations.

By leveraging prequalification, financial institutions can attract engaged and eligible consumers into their loan origination funnel. With consumers already screened and matched to the right products, prequalification significantly increases approval rates. It ensures that the most suitable products, ones that consumers are most likely to buy and qualify for, are presented directly to them.

How is prequalification different than prescreen?

Prequalification differs from prescreen in several ways. While prescreen is initiated by the lender and involves segmenting a prospect list to decrease acquisition and mailing costs, prequalification is a consumer consent-based credit screening tool. In prequalification, the consumer opts-in to see which credit products they may be qualified for in real time at the point of contact. Unlike prescreen, which is initiated by the lender, prequalification is initiated by the consumer. This empowers consumers to explore their eligibility for credit products without any obligations.

Strong prescreen and prequalification marketing strategies complement each other effectively. Prescreen marketing is designed to attract new prospects and engage existing customers, encouraging them to explore credit options through branches or online channels. On the other hand, prequalification provides consumers with additional credit options beyond what has been screened for them. This means that prequalification expands the range of credit products available to consumers, allowing them to consider personalized offers that align with their specific needs and qualifications. By combining prescreen and prequalification strategies, lenders can maximize their outreach efforts and provide a more comprehensive credit experience for consumers.

What are the standout features and capabilities that differentiate Zoot from its competitors?

Zoot’s biggest competitive advantage lies in its exceptional flexibility, offering clients unparalleled adaptability to tailor solutions to their unique needs. This flexibility translates into numerous benefits for clients, including the ability to seamlessly integrate with existing systems, customize processes for optimal efficiency, and swiftly respond to evolving market demands, ultimately driving greater agility, scalability, and competitive advantage for the organization.

What makes Zoot's prequalification solution better than its competitors?

Zoot’s prequalification solution offers several business benefits that set it apart from competitors. It can be seamlessly deployed as part of another solution from Zoot or used to augment existing systems, products, or platforms.

By integrating Zoot’s prequalification solution into their existing technology, lenders can maximize the value of every customer interaction. With real-time credit evaluation and personalized credit options, Zoot’s solution enhances the customer experience, making it easier for customers to explore and consider credit options.

Zoot’s solution also provides flexible decisioning capabilities, allowing lenders to easily connect to internal and third-party data sources. This intuitive integration enables lenders to make informed decisions based on a comprehensive set of data, improving the accuracy and effectiveness of their credit evaluations.

Finally, Zoot’s prequalification solution operates within their purpose-built private cloud, providing a secure and reliable environment for decision-making and data requirements. This eliminates the need for lenders to operate and manage their own data centers, reducing operational complexities and costs.

Ready to Take the First Step?

Explore Zoot’s Capabilities or schedule a consultation with our team to learn how our prequalification solution for banks, credit unions, and fintechs can make an impact at your organization.

Prequalification Resources

Unlock Opportunities, Elevate Your Business

In today’s fast-paced market, staying ahead demands more than just innovation – it requires precision. Balancing innovation and stability is a constant struggle for businesses aiming to grow.

Enterprise Grade Decision Engine

Top-tier financial institutions are facing pressure to reduce their IT costs while at the same time delivering new digital solutions faster. Now is the time to...

Orchestrate the Experience

Break free of single threaded data and time-consuming manual processes that create risk and inefficiency in your organization.