Advanced Merchant Vetting & Monitoring

Swiftly Manage Risk with Efficient Merchant Vetting

Fortify your merchant acquisition and monitoring processes with Zoot’s comprehensive vetting solution that enables seamless onboarding,

continuous fraud surveillance, and the integration of premium data sources and advanced decision-making logic.

Improve Underwriting Efficiency

Access a wide variety of business & consumer credit data & experience the flexibility to assess merchant risk on a case-by-case basic, originating applications according to your own business logic without IT assistance.

Monitor and Manage Risk

Track risk across any number of metrics, such as total sales, charge backs/sales ratio, historic performance, and more across various methods of payment, settlement frequency, or transaction types.

Enhance KYB & KYC Efforts

Verify merchant identities and business legitimacy to ensure reliable data-driven decisions and enhanced trust, while safeguarding against potential fraud and risks associated with illegitimate merchants.

Overview & Key Benefits

In today’s dynamic digital economy, the influx of new merchants is constant. Whether it’s a burgeoning small business expanding its online presence, an established ecommerce site looking to offer Buy Now, Pay Later (BNPL) options, or an entrepreneur venturing into online marketplaces, thorough vetting is essential before onboarding these entities into your system. The challenge lies in accurately assessing risks such as bankruptcy, attrition, and merchant fraud to mitigate potential losses while scaling your portfolio.

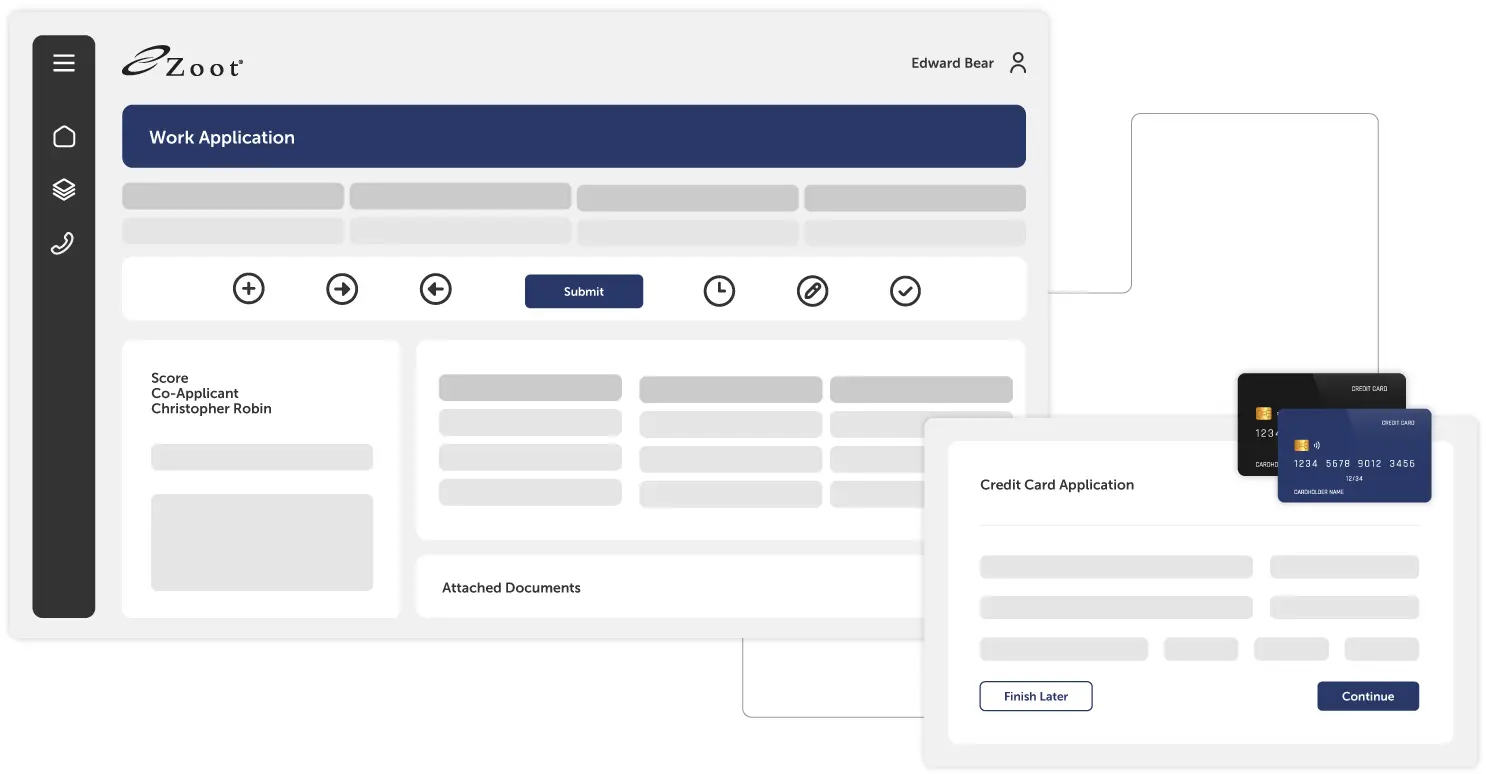

Discover the industry’s most comprehensive solution for acquiring and monitoring merchants with Zoot. Our advanced platform excels in intelligently detecting patterns and anomalies, empowering you to conduct sophisticated and efficient initial merchant vetting and continuous monitoring. By leveraging cutting-edge data analytics, Zoot ensures proactive risk management and compliance, safeguarding your business against financial uncertainties.

Whether you’re managing marketplace sellers, integrating secure credit card processing solutions, implementing new microloan/BNPL options, or facilitating Peer-to-Peer lending, Zoot offers customizable tools to streamline vetting processes and monitor merchant activities seamlessly. Enhance operational efficiency and maintain trust with robust insights and real-time monitoring capabilities, tailored to meet the evolving needs of today’s digital marketplaces.

Quick Facts

How to Reduce Fraud Risk with Advance Merchant Vetting

Approach Merchant Fraud with Eyes Wide Open

The direct and indirect costs of merchant fraud-related chargebacks, reputation risk, resource consumption, and regulatory fines can be incalculable. Impact on the bottom line is inevitable and those increased costs will eventually be passed on to merchants and consumers, potentially limiting competitive edge.

With Zoot, organizations are able to measure compliance, calculate existing and potential merchant profitability, predict fraud activity, and evaluate the likelihood of existing merchant bankruptcy. We’ll help you stay on top of the risk, so you can focus on delivering exceptional customer experiences to your merchant partners.

Merchant Vetting & Monitoring Solution Features

Our innovative Merchant Vetting & Monitoring solution offers robust features to streamline processes and simplify the onboarding process for new merchants, all while enhancing compliance and mitigating risk. Leverage data-driven insights to inform your ongoing strategy.

Fully Customizable Platform

Tailor Zoot’s Merchant Vetting & Monitoring solution to meet your specific business needs, ensuring a seamless and personalized experience for your customers.

Customizable Decision Rules

Set your own decision rules to automate vetting based on your unique business requirements, reducing manual intervention and increasing efficiency.

ID Verification

Safeguard against identity fraud and ensure the authenticity of applicants by seamlessly integrating personal and business ID verification tools.

Fraud Detection

Mitigate the risk of fraudulent activities with robust fraud detection mechanisms, protecting your business and customers from potential financial harm.

Instant Decisioning

Provide real-time decisions to merchant applicants, enhancing the customer experience and reducing wait times, resulting in higher satisfaction rates.

Powerful Integrations

Seamlessly integrate with external systems, service providers, and LLM, AI, & ML models allowing for smooth data exchange and enhancing the overall efficiency of the merchant acquisition process.

Future-Ready Flexibility

Adapt to the evolving demands of the lending industry with a flexible system that can easily incorporate new technologies and regulatory changes.

Multiple User Groups & Roles

Assign different roles and access levels to various user groups, ensuring secure collaboration across teams and maintaining data integrity.

![]()

“Our goal with the G2 Compass Score is to help financial institutions grow faster and mitigate more risk up front. The integration of the G2 Compass Score and Zoot’s world-class credit decisioning solutions accelerates these benefits significantly.”

Use Cases

Get the best end-to-end solution to drive profitable growth and support growth across lines of business, all while maintaining regulatory compliance, improving efficiency, and enhancing the customer experience.

Partners & Providers

Zoot’s partners and providers network offers clients access to an extensive global network of data and service providers, with pre-built connections to best-of-breed data sources. Our advanced capabilities enable swift integrations to new sources, providing seamless connectivity to advanced data, AI, and machine learning models. By leveraging this network, clients easily integrate high-quality data, make informed decisions, enhance risk management, and drive business growth.

Frequently Asked Questions

Is there the ability to integrate with third-party merchant onboarding, monitoring, and reporting solutions?

Yes, Zoot seamlessly integrates with third-party tools, ensuring compatibility and enhancing operational efficiency.

Can Zoot recommend data providers for new merchant vetting & monitoring?

Yes, Zoot can recommend data providers based on specific needs and requirements. Leveraging our expertise and knowledge, we assess client needs and match them with suitable data providers that align with their objectives, ensuring optimal data quality and relevance for their business goals.

Our business is unique, how customizable is the solution?

Zoot’s merchant vetting & monitoring solution is highly customizable, allowing you to tailor decision rules, risk assessments, and workflows to match your unique business logic.

Ready to Take the First Step?

Explore Zoot’s Capabilities or schedule a consultation with our team to learn how our merchant vetting and monitoring solution can make an impact at your organization.

Merchant Vetting & Monitoring Resources

No Results Found

The posts you requested could not be found. Try changing your module settings or create some new posts.