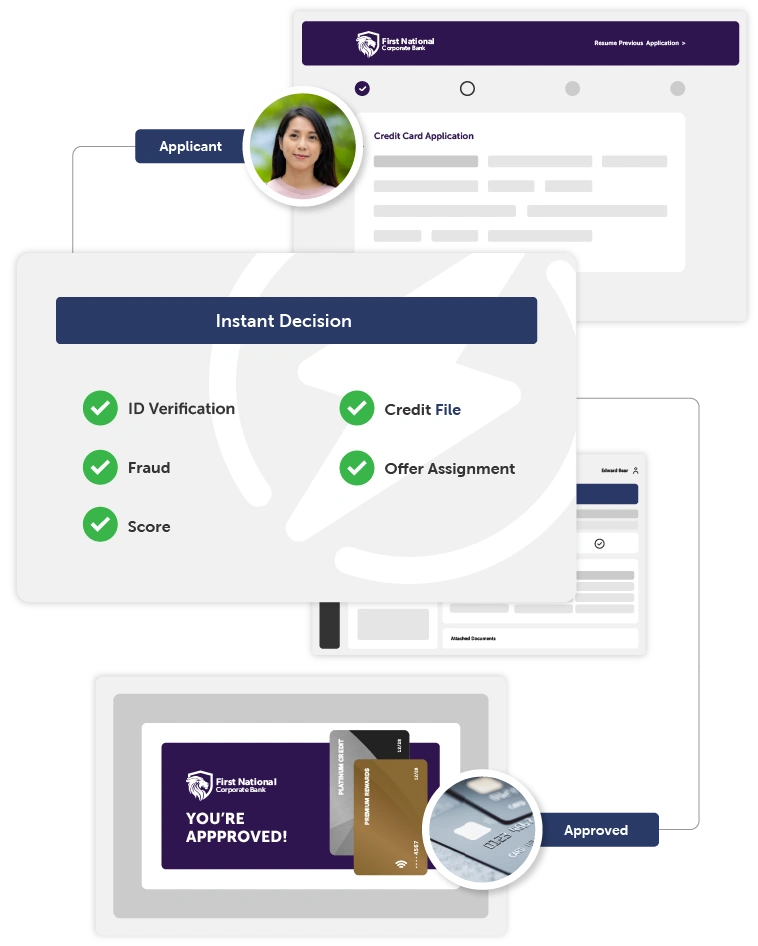

Supercharge Card Approvals & Enhance Efficiency

Leverage automated advanced decision management to reduce operational costs by up to 20% with our credit card origination system, seamlessly integrating with existing tech.

Advanced automation streamlines workflows to reduce friction and minimize pending applications, enabling you to say yes to more customers. With application data and reports in one place, decisions are made faster, reducing friction and speeding up manual review. Intuitive back office screens drive efficiency when needed.

By reducing manual, repetitive processes, your team saves time and money while speeding up processing. What higher-value activities could you focus on with all that extra time?

Grow Market Share

Strategically grow your credit card portfolio by managing risk at the cardholder level, adapting quickly to market shifts and customer needs.

Enhance Operational Efficiency

Streamline operations with our credit card origination software, pending fewer applications and shortening the timeline to a final decision.

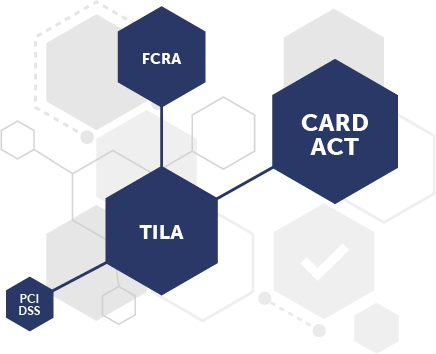

Manage Regulatory Compliance

Utilize Zoot’s flexible technology & testing tools to address compliance needs and employ best-practice credit risk management.

Accelerate Approvals, Grow Your Portfolio

Process decisions up to 100x faster with Zoot’s credit card origination system, driving digital transformation, increasing market share, and enabling sustainable revenue growth.

Zoot’s credit card origination software leverages advanced automation to pend only necessary applications, accelerating workflows, increasing approvals, and enhancing customer satisfaction. Built for scalable innovation, it helps your organization remain competitive.

Extend and scale your LOS to accomplish more with the addition of prescreen, prequalification, and other functionalities. Achieve more with a system built to power your success – today and in the future.

Meeting Your Needs,

and Exceeding Your Goals

Zoot offers a range of ready-made and fully tailored credit card origination systems designed to streamline processes and drive better outcomes. Whatever your needs, we have the perfect fit for you.

Base Credit Card Origination System

The essential tools & features your organization needs to quickly stand-up or modernize a competitive credit card program.

Industry Leading Technology:

2-6 Week Implementation*

Flexible Platform Grows with You

Single API Connection

- Full Integration with core software

Includes up to 5 Custom Credit Card Products

- Branded Application Screens

- Save & Continue Later

- Balance Transfers

- Authorized Users

- Multi-Channel Application Support

- Adverse Action Enabled

- Notes Capture, History, & Audit-Trail Tracking

- Standard Reporting

Advanced Underwriting

- Configurable User-Level Permissions

- Optimized Back-end Processes

- Standard & Custom Override Reasons

- Preformatted Decision Comments

Customizable Policy Attributes

- Consumer Credit Score Waterfall

- KYC/Fraud Triggers

- Rule Configuration

Professional

Credit Card Origination System

Our most popular solution, everything you need for rapid implementation & integration of advanced logic, data providers, and decisioning.

Everything You Need from Base:

- Industry Leading Technology

- Flexible Platform Grows with You

- Single API Connection

- Custom Credit Card Products

- Advanced Underwriting

Plus the Right Additions to

Level-Up Your Credit Card Program:

- Custom Reporting & Data Extracts

- Full Customer Marketing Support

- Additional Application Channels

- Single Sign-On Integration

Fully Customizable Decision Rules & Logic

- Industry-Leading Workflow Customization

- Configurable Routing & Queuing Logic

- Seamless Integration with Core Systems

- Actionable Customer Profile Insights

Ability to Integrate Any Data

- Full Integration of Branch & Online Banking Platforms

- Connect with 3rd Party AI Solutions

- Access Existing Connections with Over 70 Best-of-Breed Data Partners

- Seamless Integration with Any Data Source or Provider

24 / 7 / 365 Platform Monitoring & Support

Elite Credit Card Origination System

Combine tailored development, intelligent automation, & actionable data integration to streamline operations and deliver personalized customer experiences.

Guidance & Support for Any Project:

Our Elite credit card origination system empowers financial institutions with a robust, customizable platform designed to meet the demands of modern credit card origination. From tailored product development to scaled agile delivery, we partner with your team to co-develop or fully engineer solutions that match your vision.

Your Ideas Put Into Action

- Consultative Approach

- LOB, Division, or Enterprise-Wide Capable

- Future-ready, Scalable Platforms

- Efficient Development Starts with Pre-Built Libraries & Workflows

- Co-Development Flexibility

- Integration Across Systems

- Custom Data Integrations

Enhance Your Platform with Powerful Features

- Integrated Application Fraud Alerts

- Seamlessly Incorporate Batch Prescreen, Prescreen-of-One, Prequalification, and/or Cross-Sell

- Embed Offers & Applications into Any Part of the Customer Experience

24 / 7 / 365 Platform Monitoring & Support

*Implementation time may vary based on platform complexity & documentation support. Professional & Elite LOS implementations are subject to platform requirements and sizing.

Schedule a Consultation

Explore Zoot’s Capabilities or schedule a consultation with our team to learn how our LOS can make an impact at your organization.

Tackle Risk & Compliance Head-On

Regulatory requirements and evolving risks create significant challenges for financial institutions.

Zoot’s credit card origination system enables you to stay compliant with all industry standards, manage risk, and utilize robust fraud detection to protect your organization from bad actors, safeguarding operations and your reputation.

From managing user permissions based on your policy to creating audit trails, Zoot’s credit card origination system ensures control and transparency for compliance and internal reviews with traceable data and documented, exposable processes to aid your team in the case of an audit.

![]()

“If we tried to build something internally, our cost probably would have been tenfold if not more… Our ability to implement changes has been night & day better than in some internal legacy systems.”

Powering Success, Together

Every business is unique, and so are your challenges. Get up and running 30% faster with a credit card origination system tailored to your needs.

No matter if you’re using green screens, point solutions, or legacy tech that isn’t working for you anymore, making the move to a modern origination system can be daunting. Backed by decades of experience helping clients make the switch, our team of experts will help you identify the right fit for your organization and guide you through implementation.

Whether off-the-shelf or custom, real humans provide worldwide support whenever you need us. We know a critical issue or setback never happens at a convenient time, which is why we’re in your corner from start to finish.

Fuel Success

with the Right Data

Ensure confidence in every decision with access to top-tier data providers within your credit card origination system, whether enhancing risk assessment, streamlining approvals, or improving customer experiences.

Zoot’s credit card origination software centralizes data and reports, empowering analysts to drive smarter, faster decisions, and providing quicker responses to your customers by intelligently acquiring and orchestrating the right data at the right time.

Easily integrate with existing systems through Zoot’s API, simplifying communication while ensuring robust security.

Frequently Asked Questions

How long does it take to implement Zoot’s credit card origination system?

Zoot’s credit card origination system is designed for rapid deployment, with typical implementation timelines ranging from weeks to months. The exact timeframe depends on factors such as the level of customization and integration needs. Our experienced team collaborates closely with your organization to ensure a smooth and efficient integration process, minimize disruption, and accelerate time to revenue.

Can Zoot’s credit card origination system integrate with our existing systems?

Absolutely. Zoot’s credit card origination system is built with seamless integration in mind. Our solution connects with your existing systems, data providers, and other third-party solutions using robust APIs. Our team works closely with you to ensure smooth integration, enabling your systems to work together efficiently.

Can Zoot’s credit card origination system be used across multiple lines of business?

Yes, Zoot’s credit card LOS is highly flexible and can be configured to support multiple lines of business with higher levels of customization. Whether you are managing credit cards, personal loans, or other financial products, the modular design of our solution allows you to tailor workflows, rules, and decisioning to meet the unique needs of each product line. This versatility ensures a consistent and efficient origination process across your entire organization.

Ready to Take the First Step?

Explore Zoot’s Capabilities or schedule a consultation with our team to learn how our LOS can make an impact at your organization.

Origination Resources

The Anatomy of a Modern Installment Loan Origination System

Installment loans offer borrowers predictable repayment and lenders a clear, scalable path to growth. As demand for fast, digital...

GenAI in Credit Decisioning

Generative AI is reshaping credit decisioning, but real ROI requires a disciplined, responsible approach.As financial institutions face...

Fireside Chat: Streamlining the Customer Experience with Equifax & Zoot

In today's fast-paced financial sector, accessing data is crucial, but integrating it effectively into decision-making is key to...