Application fraud, once considered a sporadic issue, is now a fast-moving, ever-evolving threat. In 2025, it’s not just about a few bad actors slipping through the cracks. It’s an industrial-scale problem fueled by sophisticated tactics, prominent data leaks, and the digital-first strategies many institutions have embraced.

As financial institutions prioritize fast and seamless onboarding to stay competitive, the opportunities for fraudsters have multiplied. The question isn’t whether your organization is exposed – it’s how well prepared you are to detect and prevent what’s coming your way.

The Scope of the Problem

Application fraud in the U.S. is growing at a startling pace. According to a 2024 report by the Federal Trade Commission, identity related fraud, including application based schemes, accounted for over $11.7 billlion in reported losses, a 21% increase over the prior year. Industry analysts project application fraud alone could cost U.S. institutions upwards of $5 billion in 2025 if left unchecked. Consumers have skin in the game here as well with fraud related losses amounting to $12.4 billion in 2024, a 25% increase from the previous year.

What makes this type of fraud particularly dangerous is its versatility and stealth. Fraud rings now routinely leverage synthetic identities to open multiple fraudulent accounts over time, using these manufactured profiles to slowly build credit and trust. These synthetic identities are often undetected for months, or even years, until they “bust out” with large loans or credit lines and disappear, leaving financial institutions to foot the bill.

The impact is felt across the board:

- Banks and credit unions suffer direct financial losses, reputational damage, and increased regulatory scrutiny.

- Fintechs, with their focus on streamlined digital experiences, are especially vulnerable to automated, high-volume fraud attacks.

- Consumers face identity theft, financial loss, compromised credit histories, and the emotional toll of restoring their financial reputations.

What’s Fueling the Surge?

Several systemic issues have converged to create a perfect storm for application fraud.

- Personally identifiable information (PII) is everywhere. With hundreds of data breaches occurring annually, sensitive personal information is widely available for sale online.

- Digital onboarding is also full of gaps. In the rush to provide seamless user experiences, many institutions overlook key identity verification steps.

- Fraudsters are automating, too. Just as financial institutions use AI to improve operations, criminals use generative AI to create fake documents, mimic voice responses, and mass-produce applications.

- Speed is winning over security. The pressure to approve applications quickly, especially in lending or buy now pay later scenarios, often means risk goes unassessed until it’s too late.

Types of Application Fraud

Here’s a closer look at the major types of fraud disrupting the financial landscape:

1st Party Fraud

A legitimate applicant intentionally defaults or misrepresents financial information.

Example: A borrower applies for a loan with no intent to repay, knowing the institution lacks sufficient early detection.

3rd Party Fraud

Fraudsters use stolen or fake identities, often enhanced by AI or deepfake tools.

Example: Criminals use stolen identity details they purchased on the dark web to open a credit card and quickly max it out.

Synthetic Fraud

Combines real and fake personally identifiable information (PII) to create new identities.

Example: A fraud ring creates fake profiles using real minors’ SSNs, opens credit accounts, and exploits the system over time.

As financial institutions prioritize fast and seamless onboarding to stay competitive, the opportunities for fraudsters have multiplied. The question isn’t whether your organization is exposed – it’s how well prepared you are to detect and prevent what’s coming your way.

The Challenge of Detection

Detecting application fraud isn’t just difficult – it’s increasingly outpacing the capabilities of traditional systems. Many institutions still rely on rules-based models or batch data processing, which are simply too slow or rigid to catch fast-moving, adaptive fraud attempts.

Compounding the problem is the time lag between account creation and fraud realization. For instance, synthetic identities might build trust slowly, making small payments over months before suddenly defaulting. By the time the fraud is discovered, it’s far too late.

As fraud tactics become more sophisticated, manipulated credentials and AI-generated documents are fooling systems that weren’t designed to verify authenticity at that level. Institutions without cross-functional collaboration between fraud, risk, and onboarding teams often find themselves working in silos, missing key indicators that could have prevented the fraud in the first place.

How Zoot Can Help

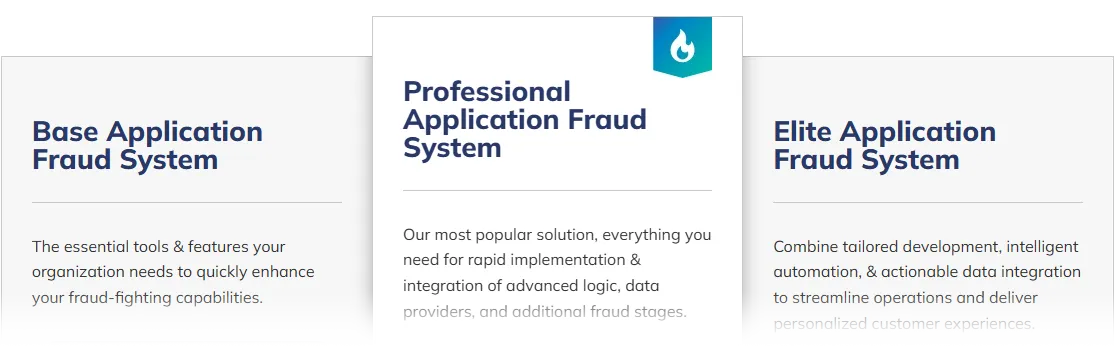

Zoot’s off-the-shelf application fraud solution offers financial institutions a scalable, intelligent platform to stay ahead of fraud trends without sacrificing speed or user experience. Seamlessly integrate your solution with your existing tech to test various fraud-fighting strategies, compare a variety of data providers for optimal outcomes, and adapt to fight emerging trends.

Built to enable confident approvals for the right customers while driving down risk, multiple fraud stages and orchestration types are at your disposal and can be up and running within weeks. Or, explore our Elite solutions for even more robust, customizable platforms designed to match your vision.

The surge in application fraud isn’t a blip on the radar – it’s a signal that institutions must adapt now or fall behind. By investing in smarter, more flexible defenses, FIs can prevent losses, protect consumers, and build trust in a digital-first future.

Ready to strengthen your fraud defenses? Get in touch with our team to discover how Zoot’s solutions will make an impact at your organization.