Preparing for the Future of Consumer Lending and Debt

In the shadow of rising delinquency rates, financial institutions (FIs) are strategically investing to minimize losses and ensure the health of their loan portfolios.

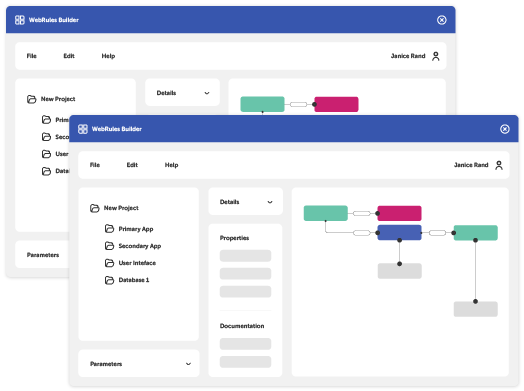

By upgrading technology to modernize collections operations, FIs can maximize recovery, reducing charge-offs while retaining customers. From re-evaluating the underwriting process and increasing loan reserves to streamlining operations and prioritizing digital initiatives, FIs are laying the groundwork to successfully navigate the shifting financial landscape.

See the various approaches FIs are taking to prepare for whatever the future may bring.

See How FIs are Managing Risk Despite:

- BNPL credit reporting gaps

- Increasing loan modification exits

- Student loan uncertainty

- and more

\\\ Whitepaper

Collections & Debt Recovery

We’ll never share your information

Delinquency Prevention & Account Management

Take An In-Depth Look

Streamline your collections and recovery process with a Zoot solution. Our flexible, nimble platform gives you an unprecedented level of control and flexibility for pre-delinquency, delinquency and post charge-off process management, across multiple portfolio segments and communication channels.

Additional Resources

Explore our collection or valuable resources designed to provide you with in-depth insights and help you make informed decisions. Discover how Zoot Solutions can empower your business.

Woodburning Stephen Johnson

The Zoot Art Gallery in Bozeman is pleased to announce its all new exhibit, “Woodburning,” presented by artist Stephen Johnson.Stephen...

Zoot’s Experience at Banking Transformation Summit 2025

The Banking Transformation Summit 2025 brought together leaders who are shaping the next decade of financial services. From AI...

BNPL Lending: Trends, Risks, and How Lenders Can Stay Ahead

Buy Now, Pay Later (BNPL) has moved from a niche e-commerce feature to a defining force in consumer credit. Once dominated by fintech...