Delinquency Prevention & Account Management

Streamline Processes

& Reduce Delinquencies

Optimize your delinquency management approach by identifying and implementing innovative prevention strategies, boosting recovery rates and operational efficiency, and delivering enhanced customer experiences across various channels

Create Consistent Outreach

Tailor communications to delinquent borrowers based on when & how they are contacted while managing the distribution of letters & emails sent.

Focus, Adapt, and Iterate

Minimize your effort, time, and cost by adopting an approach based on probability of repayment to maximize the amount of debt collected.

Review and Report

Automate, schedule, and deliver reports across the enterprise with configurable exports to both internal and external systems. Facilitate better decision-making & promote data-driven strategies

Overview & Key Benefits

Managing prioritization, segmentation, and communications to prevent delinquency can become chaotic. You need a tool to reduce the risk of accounts going delinquent and to streamline your efforts.

Automate your prioritization strategies, segment portfolios, and standardize your external communications from one intuitive interface with easy access to the data you need. Plus, deliver best-in-class customer experiences with increased account visibility and standardized processes.

Streamline your collections and recovery process with Zoot. Our nimble, flexible platform provides an unprecedented level of control for predelinquency, delinquency, and post charge-off process management across multiple portfolio segments and communication channels.

Quick Case Study

Maximizing Delinquency Intervention Success: How Zoot’s Solution Drives Profitability

The rate of delinquency intervention success significantly improves with early action. When an automotive dealer aimed to reduce the number of accounts being sent to collections annually, they came to Zoot for help.

By leveraging flexible tools, a vast data partner network, and the client’s own internal data, Zoot successfully implemented a solution that identified accounts most at risk of nonpayment, allowing the client to step in early and interact with those customers to create a plan.

With valuable data and insights from their Zoot solution, the automotive dealer was able to identify at-risk accounts prior to engaging in the collections process and take action to mitigate that risk, resulting in fewer delinquent accounts and increased profitability.

Delinquency Prevention Solution Features

Streamline processes and manage risk with Zoot’s Delinquency Prevention solution. Leveraging advanced decision management capabilities and best practices, our solution provides your organization with the ability to manage accounts more effectively and reduce the likelihood of delinquencies.

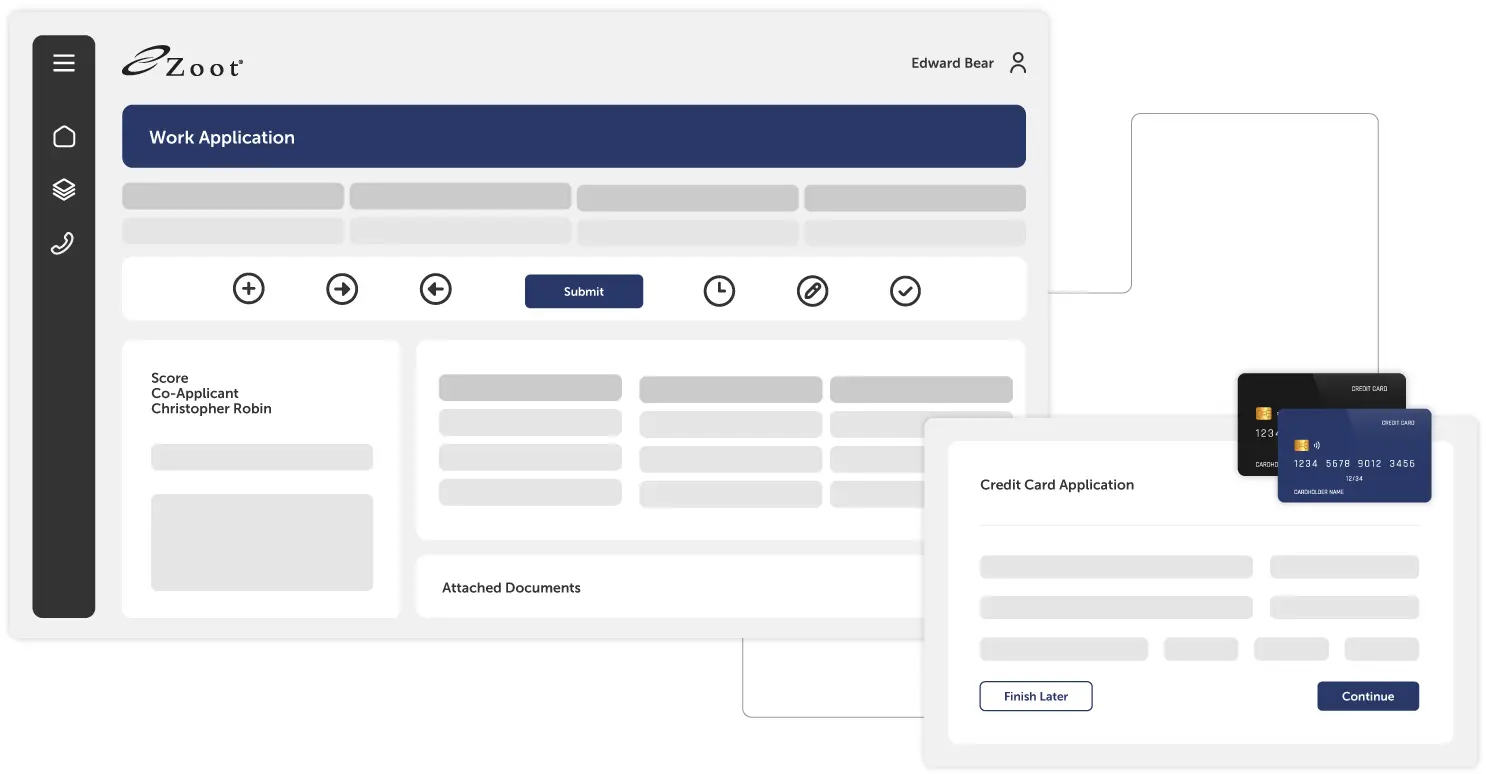

Fully Customizable Platform

Tailor Zoot’s LOS to meet your specific business needs, ensuring a seamless and personalized experience for your customers.

Consumer-Facing Application Screens

Engage and empower your customers with user-friendly and intuitive application screens.

Instant Decisioning

Provide real-time loan decisions to applicants, enhancing the customer experience and reducing wait times, resulting in higher satisfaction rates.

Fully Customizable Platform

Tailor Zoot’s solution to meet your specific business needs, ensuring a seamless and personalized experience for your customers.

Customizable Decision Rules

Set your own decision rules to automate alerts based on your unique business requirements, reducing manual intervention and increasing efficiency.

Fraud Detection

Mitigate the risk of fraudulent activities with robust fraud detection mechanisms, protecting your business and customers from potential financial harm.

Instant Decisioning

Provide real-time payment plans and decisions, enhancing the customer experience and reducing wait times, resulting in higher satisfaction rates.

Powerful Integrations

Seamlessly integrate with external systems and service providers, allowing for smooth data exchange and enhancing overall efficiency.

Future-Ready Flexibility

Adapt to the evolving demands of the financial industry with a flexible system that can easily incorporate new technologies and regulatory changes.

Multiple User Groups & Roles

Assign different roles and access levels to various user groups, ensuring secure collaboration across teams and maintaining data integrity.

Real-Time Risk Assessment

Leverage the latest data to determine the current risk of accounts going delinquent, enabling you to proactively focus on prevention strategies.

![]()

“Zoot’s solutions and the ability to connect to multiple data providers have allowed us to make quick, data driven decisions to protect the financial well-being of our portfolio. We are able to make fast updates to our platforms, which have allowed us to be successful in an ever-changing risk environment.”

Use Cases

Get the best end-to-end solution to drive profitable growth and support your specific lines of business, all while maintaining regulatory compliance, improving efficiency, and enhancing the customer experience.

Partners & Providers

Zoot’s partners and providers network offers clients access to an extensive global network of data and service providers, with pre-built connections to best-of-breed data sources. Our advanced capabilities enable swift integrations to new sources, providing seamless connectivity to advanced data, AI, and machine learning models. By leveraging this network, clients easily integrate high-quality data, make informed decisions, enhance risk management, and drive business growth.

Frequently Asked Questions

How can Zoot's solution help in identifying accounts at risk of delinquency?

Zoot’s solution uses advanced data analytics and scoring models to evaluate and flag accounts based on various risk factors such as payment history, credit score changes, and external data inputs. This helps in identifying accounts that are at a higher risk of delinquency early on.

Can the system be customized to fit our specific risk management strategies?

Yes, Zoot’s platform is highly customizable. You can set your own decision rules, tailor communication strategies, and adjust prioritization and segmentation criteria to align with your specific risk management strategies.

How does the solution improve customer communication?

The solution allows you to automate and tailor communications based on the risk profile and behavior of each account. This ensures that customers receive timely and relevant messages through their preferred channels, improving engagement and compliance.

What kind of data does the platform integrate with for risk assessment?

Zoot’s delinquency prevention solution integrates with a wide range of data sources, including internal bank data, credit bureau information, and third-party data providers. This comprehensive data integration enables a more accurate and holistic risk assessment.

Can proposed rules be tested in real-time?

Yes, proposed rules can be tested in real-time using Zoot’s platform, allowing for immediate feedback and refinement to optimize outcomes.

Ready to Take the First Step?

Explore Zoot’s Capabilities or schedule a consultation with our team to learn how our delinquency prevention solution can make an impact at your organization.

Delinquency Prevention Resources

CBA Live 2025 Recap

CBA Live 2025 brought together over 1,700 attendees, including 700+ senior-level bankers, from across the retail banking industry to...

Unlock Opportunities, Elevate Your Business

In today’s fast-paced market, staying ahead demands more than just innovation – it requires precision. Balancing innovation and stability is a constant struggle for businesses aiming to grow.

Enterprise Grade Decision Engine

Top-tier financial institutions are facing pressure to reduce their IT costs while at the same time delivering new digital solutions faster. Now is the time to...