Installment loans offer borrowers predictable repayment and lenders a clear, scalable path to growth. As demand for fast, digital lending increases, modern origination systems play a critical role in delivering these products efficiently and responsibly.

The Evolution of Installment Loan Origination

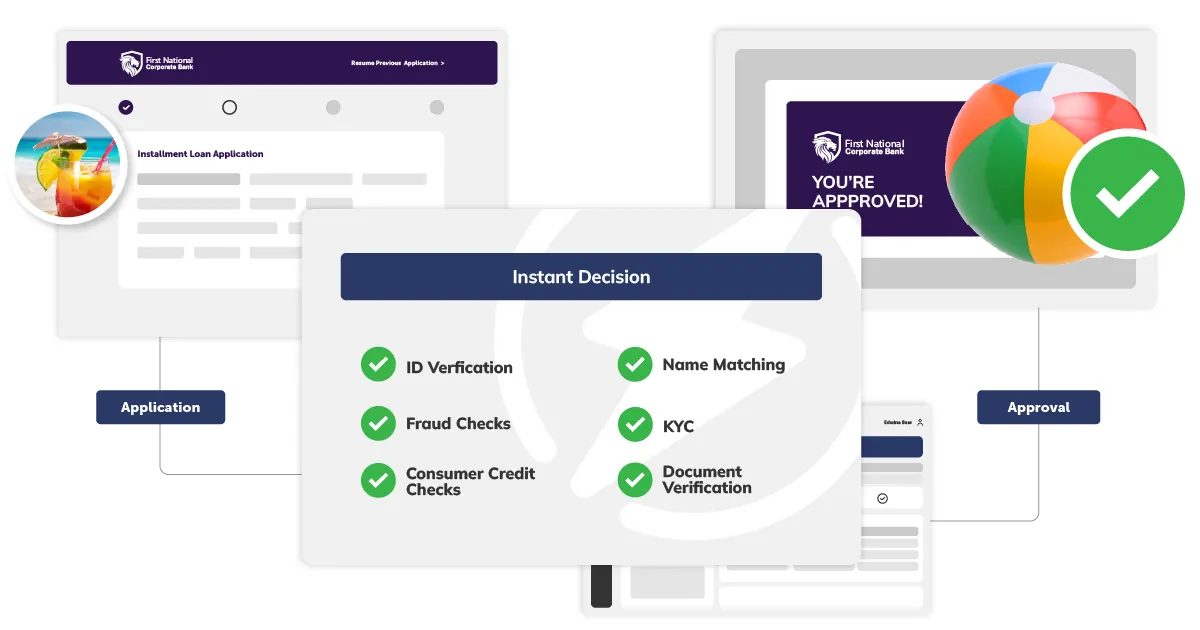

Installment loan origination has evolved rapidly as borrower expectations and market demands have shifted. Today’s borrowers expect seamless digital applications, fast decisions, and transparency throughout the process, particularly when applying for installment loans that often support major financial needs. At the same time, lenders must manage increasing data volumes, regulatory complexity, and pressure to scale efficiently while delivering these structured, long-term products. A modern installment loan origination system (LOS) brings these requirements together, serving as the foundation for efficient, data-driven lending..

Moving Beyond Legacy Origination Systems

Legacy origination systems were typically built for limited products and rigid decision rules, which made them difficult to adapt as installment lending expanded across new channels and borrower segments. These systems often require costly redevelopment to support new loan terms, pricing structures, or compliance updates. Modern LOS platforms are designed for flexibility, enabling lenders to quickly adjust decision strategies, introduce new installment products, integrate additional data sources, and respond to regulatory changes without slowing down operations.

Designing a Seamless Borrower Experience

Borrower experience is a core focus of modern installment loan origination. Installment loans are frequently used for important life expenses, making clarity and ease of use especially critical during the application process. Digital application flows support web, mobile, branch, and partner channels, reducing friction and improving completion rates. Real-time validation, guided workflows, and data prefill capabilities help ensure accuracy while minimizing effort, giving borrowers confidence in both the product and the lender.

Data-Driven Decisioning with Built-In Risk Controls

At the core of a modern LOS is real-time data integration and automated decisioning. API-driven connectivity enables access to credit bureaus, identity verification services, fraud tools, and alternative data sources, while configurable underwriting rules and scoring models support consistent, scalable decisions. Embedded risk and compliance controls ensure policy enforcement, auditability, and confidence in regulatory adherence.

Understanding Installment Loans and Their Role in Modern Lending

Installment loans are a foundational lending product designed to provide borrowers with access to a fixed amount of funds that are repaid over time through predictable, scheduled payments. Because the structure is clearly defined at origination, borrowers understand exactly how much they owe, how long repayment will take, and what their monthly obligation will be. This transparency makes installment loans especially well-suited for planned and unplanned expenses alike, while giving lenders a consistent, manageable way to extend credit.

Installment loans are commonly used to support a wide range of borrower needs, including:

- Home improvements and repairs, where borrowers benefit from predictable payments over longer terms

- Medical expenses, offering fast access to funds with manageable repayment schedules.

- Debt consolidation, helping borrowers simplify multiple balances into a single, structured payment

- Education or professional development, where financing supports long-term personal investment

- Major purchases or life events, providing flexibility without revolving debt

From a lender’s perspective, installment loans offer several strategic advantages:

- Defined loan terms and repayment schedules, enabling clearer risk assessment and forecasting

- Consistent cash flow, supported by scheduled payments over the life of the loan

- Flexible product configuration, including variable terms, pricing, and credit tiers

- Stronger borrower relationships, driven by longer-term engagement compared to short-duration credit products

As borrower demand for installment loans continues to grow, delivering these products efficiently requires more than just attractive terms. A modern loan origination system ensures installment loans are offered responsibly and at scale by supporting real-time decisioning, accurate pricing, and embedded compliance, bridging the gap between borrower needs and lender operational excellence.

Powering Scalable, Modern Origination with Zoot

Zoot’s installment loan origination solution brings these capabilities together in a single, flexible platform that enables lenders to scale across products and channels without sacrificing control. By unifying data integration, decisioning, analytics, and governance, Zoot helps lenders deliver seamless borrower experiences, manage risk effectively, and stay agile as the future of lending continues to evolve.