Loan Origination

Increase Efficiency

& Process More Loans

Supercharge your loan origination process by accelerating approvals, driving efficiency, and promoting profitable growth, while simultaneously enhancing the customer experience.

Drive Profitable Growth

Hone your competitive advantage & cost-effectively build more profitable portfolios with Zoot’s LOS. Manage risk at the customer level & adapt to changes

Improve Operational Efficiency

Improve your productivity with automated decisioning, while increasing approval rates and identifying cross-selling opportunities with our LOS.

Manage Regulatory Compliance

Utilize Zoot’s flexible, configurable technology & readily available testing tools to address compliance needs & employ best-practice credit risk management.

Overview & Key Benefits

Organizations often face the challenge of mitigating risk while closing as many loans as possible. How do you balance resource allocation, risk management, and growth effectively?

Our comprehensive Loan Origination System (LOS) streamlines the entire lending journey, from application and credit scoring to integration with service providers across multiple markets, segments, and channels. Zoot’s technology enables you to close more loans faster, and with fewer resources – all with an unprecedented level of control and flexibility.

Reduce processing times with Zoot’s loan origination solution while avoiding costly errors with robust tools and seamless integrations to minimize data entry. Enjoy the flexibility to adjust to the rapidly changing marketplace, establish and manage individual business standards, and automate transactions across multiple lines of business.

Quick Case Study

Revolutionizing Consumer Credit Card Growth with Zoot’s LOS

Struggling to modernize their credit card operations due to a legacy core banking system facing obsolescence, a top-5 retail bank found a solution through Zoot.

By leveraging expertise and industry insights, Zoot successfully implemented a comprehensive strategy addressing both immediate needs and long-term goals.

Via the adoption of Zoot’s loan origination platform, the bank achieved a stronger competitive position by attracting new customers and retaining existing ones, leading to increased market share and revenue growth. In addition, improved scalability and streamlined processes resulted in increased flexibility, productivity, and cost savings.

Loan Origination System Features

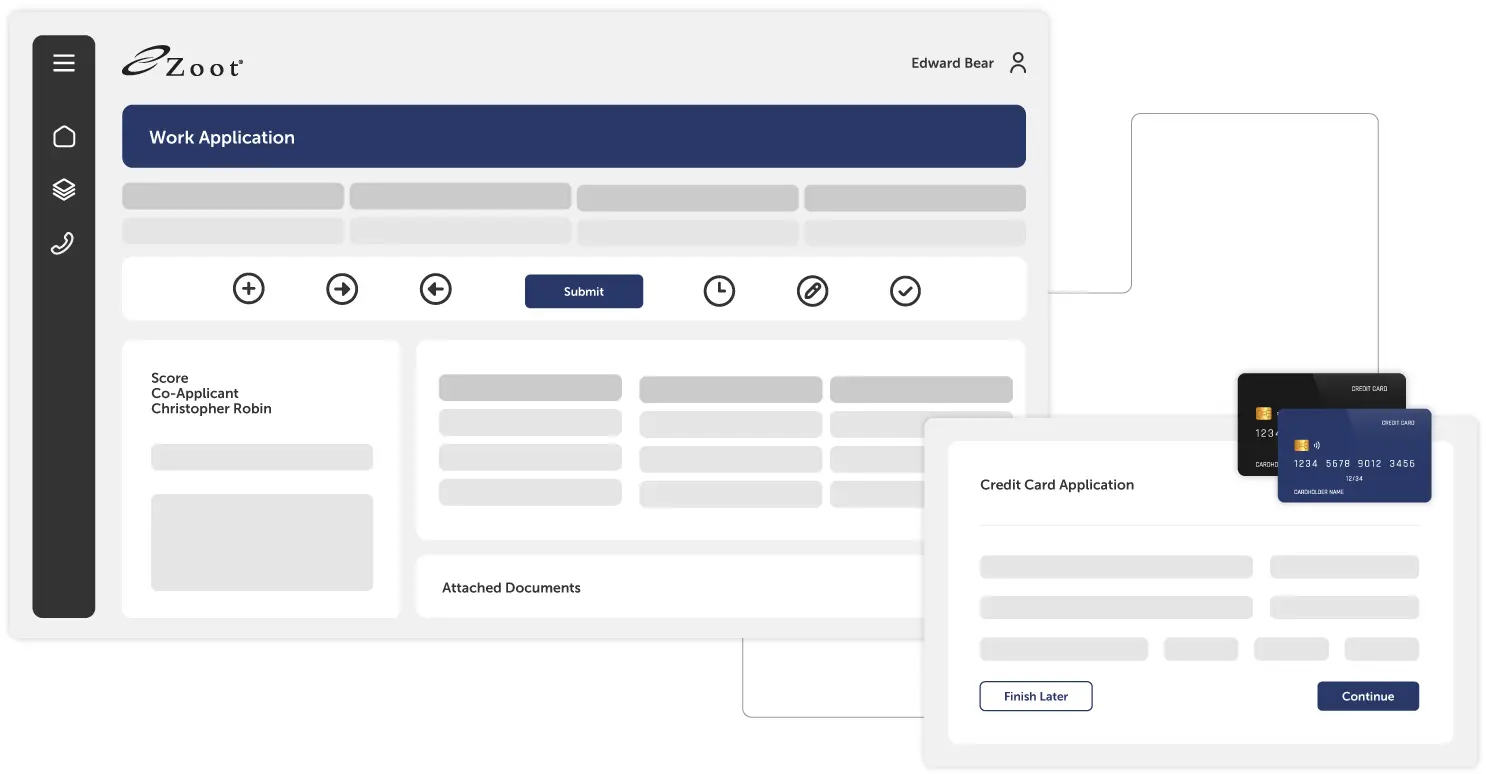

Introducing the Powerful Features of Zoot’s LOS. Built on decades of user feedback and UX/UI optimization, our intuitive interface empowers your team to make quick decisions and seamlessly integrate with your automated processes. Reduce review time and get offers out faster with our efficient solution.

Fully Customizable Platform

Tailor Zoot’s LOS to meet your specific business needs, ensuring a seamless and personalized experience for your customers.

Consumer-Facing Application Screens

Engage and empower your customers with user-friendly and intuitive application screens.

Instant Decisioning

Provide real-time loan decisions to applicants, enhancing the customer experience and reducing wait times, resulting in higher satisfaction rates.

Fully Customizable Platform

Tailor Zoot’s LOS to meet your specific business needs, ensuring a seamless and personalized experience for your customers.

Consumer-Facing Application Screens

Engage and empower your customers with user-friendly and intuitive application screens, making the loan origination process effortless and enjoyable.

Back Office Underwriting Access

Gain comprehensive access to the underwriting process, allowing for efficient evaluation and decision-making, ultimately speeding up loan approvals.

Manually Work Applications to Completion

Have full control over the loan origination process by manually working through applications, ensuring accuracy and attention to detail.

Customizable Decision Rules

Set your own decision rules to automate loan approvals based on your unique business requirements, reducing manual intervention and increasing efficiency.

ID Verification

Safeguard against identity fraud and ensure the authenticity of applicants by seamlessly integrating ID verification tools into the loan origination system.

Fraud Detection

Mitigate the risk of fraudulent activities with robust fraud detection mechanisms, protecting your business and customers from potential financial harm.

Instant Decisioning

Provide real-time loan decisions to applicants, enhancing the customer experience and reducing wait times, resulting in higher satisfaction rates.

Powerful Integrations

Seamlessly integrate with external systems and service providers, allowing for smooth data exchange and enhancing the overall efficiency of the loan origination process.

Future-Ready Flexibility

Adapt to the evolving demands of the lending industry with a flexible loan origination system that can easily incorporate new technologies and regulatory changes.

Multiple User Groups & Roles

Assign different roles and access levels to various user groups, ensuring secure collaboration across teams and maintaining data integrity throughout the loan origination process.

![]()

“…Zoot’s loan origination solution allow(s) us to directly manage the path and flow of the application from beginning to end, where previously our level of control was over the decisioning portion. The ability to make changes on our own across the entire origination process allows us to control our own destiny.”

Use Cases

Get the best end-to-end solution to drive profitable growth and support your specific lines of business, all while maintaining regulatory compliance, improving efficiency, and enhancing the customer experience.

Partners & Providers

Zoot’s partners and providers network offers clients access to an extensive global network of data and service providers, with pre-built connections to best-of-breed data sources. Our advanced capabilities enable swift integrations to new sources, providing seamless connectivity to advanced data, AI, and machine learning models. By leveraging this network, clients easily integrate high-quality data, make informed decisions, enhance risk management, and drive business growth.

Frequently Asked Questions

Is Zoot capable of implementing AI/ML models?

Yes, Zoot’s technology currently enables seamless integration of third-party hosted AI/ML models into flow diagrams, enhancing decisioning-making capabilities and workflow optimization. Zoot is also actively exploring additional avenues to implement AI, including the incorporation of pre-trained AI models and the development of AI plugins or modules. By leveraging these advancements, Zoot aims to further empower its user with advanced AI capabilities, driving enhanced efficiency and innovation across its platform.

How long does it take to build a new solution with Zoot's platform?

The time it takes to build a new solution with Zoot’s platform varies depending on the complexity and specific requirements. However, our streamlined processes, composable architecture and customizable tools enable efficient solution development.

What are the standout features and capabilities that differentiate Zoot from its competitors?

Zoot’s biggest competitive advantage lies in its exceptional flexibility, offering clients unparalleled adaptability to tailor solutions to their unique needs. This flexibility translates into numerous benefits for clients, including the ability to seamlessly integrate with existing systems, customize processes for optimal efficiency, and swiftly respond to evolving market demands, ultimately driving greater agility, scalability, and competitive advantage for the organization.

Ready to Take the First Step?

Explore Zoot’s Capabilities or schedule a consultation with our team to learn how our LOS can make an impact at your organization.

Origination Resources

GenAI in Credit Decisioning

Generative AI is reshaping credit decisioning, but real ROI requires a disciplined, responsible approach.As financial institutions face...

Fireside Chat: Streamlining the Customer Experience with Equifax & Zoot

In today's fast-paced financial sector, accessing data is crucial, but integrating it effectively into decision-making is key to...

BNPL Lending: Trends, Risks, and How Lenders Can Stay Ahead

Buy Now, Pay Later (BNPL) has moved from a niche e-commerce feature to a defining force in consumer credit. Once dominated by fintech...