Small businesses are the backbone of the US economy and an integral part of the communities they serve every day. But when nearly half of small businesses don’t survive more than 5 years, it brings about a major concern for those who provide small business lending. How do you make sure that the businesses you’re lending money to will last long enough to repay it?

What is the State of Small Business Lending?

Running a small business comes with a multitude of complexities and roadblocks, though when the US Chamber of Commerce listed the top five challenges for small business owners across the country, access to credit was second on the list. 77% of small businesses are worried about having access to capital they need to operate and grow their businesses, with most finding it difficult to obtain financing that is affordable and sustainable.

According to Forbes, there is a substantial gap in financial services for small business owners. Only 42% of small businesses have access to the funds they need, with most of them relying on banks to secure funding. Unfortunately, the number of businesses applying for traditional loans is falling, along with the number of owners who actually receive the full amount of funds they need when they apply. Back in June 2022, larger banks approved around 15% of small business loan applications. At smaller banks that number was around 20%, and has continued to drop significantly from 2019’s near 50% approval rate.

Interest rates have continued to climb in past years, and with the recent collapse of three regional banks financial institutions aren’t taking any chances. Both large and small banks have tightened their standards for small business lending, resulting in business owners being denied loans, delaying plans for growth, or turning to other sources of funding to accomplish their goals.

Though the picture painted above seems bleak, the world of small business lending is ripe with opportunity. The key is ensuring that the reward is worth the risk, which comes down to making consistent, quality decisions with the right data at your disposal.

Enrich Your Decision Making with More Data

Determining creditworthiness for a small business comes down to a lot more than a credit score alone. Utilizing a wide variety of data types to craft a complete picture of the situation at hand is critical for ensuring the proper decision is made. Incorporating alternative data to further verify payment history, mitigate fraud risk, and assess ability to pay is a great start.

Taking it one step further, consider implementing cash flow underwriting into your decision logic to provide the missing link to your holistic customer view. With the help of cash flow analysis, shifts in income can be detected with just a few weeks of data, providing an extra layer of confidence when it comes to the risk of nonpayment. Connect to a partner with a vast data ecosystem to allow for easy access to this data and more within your decision process.

Gain a Comprehensive View of Applicants

According to the US Chamber of Commerce, 82% of small businesses that fail do so due to cash flow problems. A business may look profitable on paper but struggle to pay its bills on time and keep up with other operational costs.

Utilizing an advanced decision management solution with access to a wide variety of data can allow you to gain more insight and visibility into cash flow issues before they become pronounced. Flagging early signs of cash flow problems such as instances of delayed payments, changing payment intervals from 30 to 90 days, and paying on the last possible day every month can allow you to spot the risk early.

Gain visibility into the status of a small business loan applicant’s deposit account, credit cards, usage of other lines of credit, revenue, and more, and bring all of that data into the decision process at the appropriate time to gain a more in-depth assessment of risk and empowering your bank to extend an offer of credit confidently.

Maximize the User Experience

In an age of automation and instant gratification, unnecessary friction during the application process is enough to deter and frustrate potential customers. It’s a delicate balancing act for many banks as they try to manage risk while providing their customers with a smooth, top-tier experience.

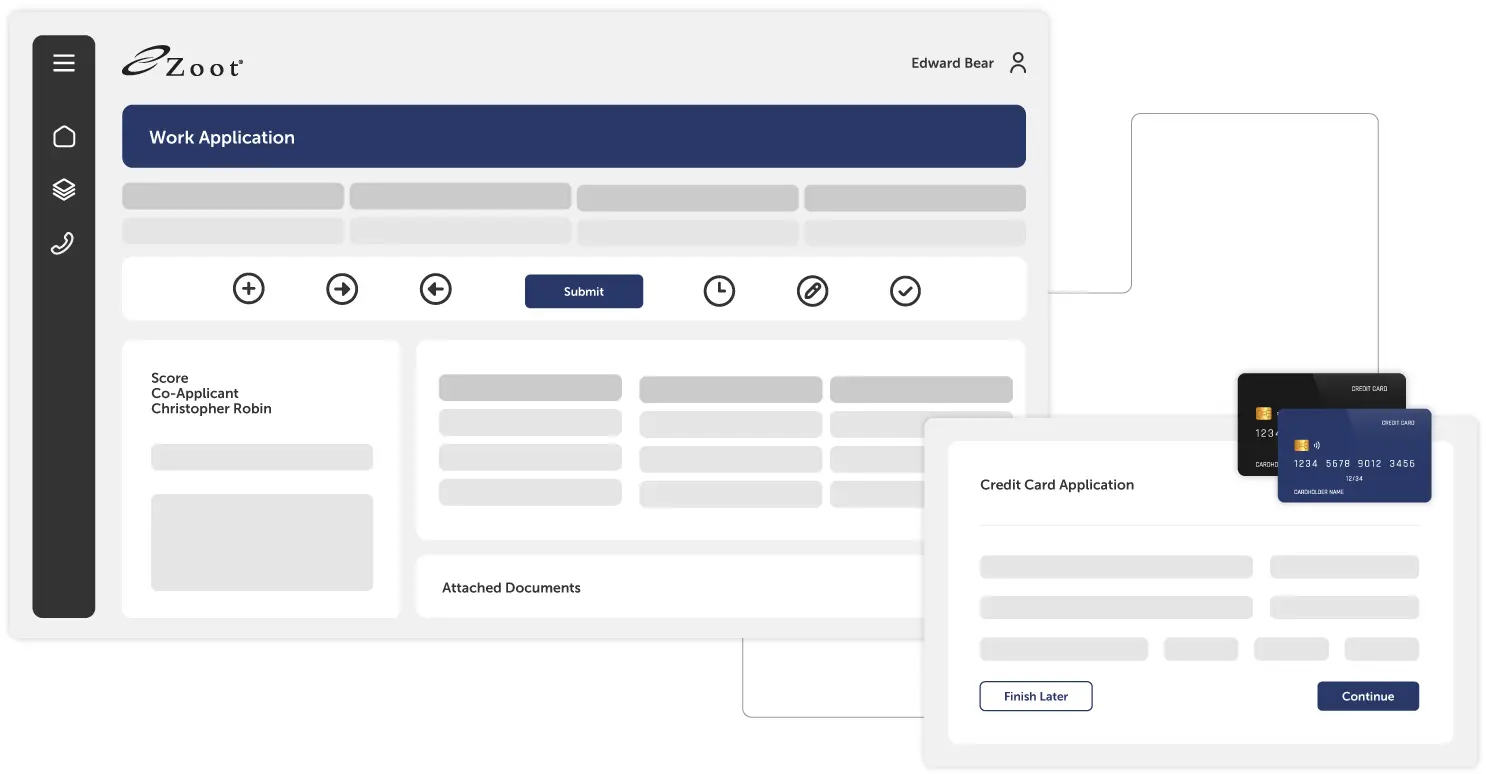

Cultivate an enjoyable, streamlined application experience by automating identity verification and risk assessment. Personalize the application process to align with your brand identity with custom application screens that will create a cohesive and consistent experience for applicants, with an intuitive mobile-responsive user interface to improve the likelihood of a completed application.

Once applications are submitted, enhance the review process with an intuitive interface that allows your underwriting team to easily navigate the workflow and speed up manual review while minimizing manual errors.

Why Choose Zoot?

With Zoot’s Small Business Lending solutions, you’ll be empowered to make precise, profitable decisions while managing your risk effectively across a range of financial products. Our innovative technology and comprehensive approach will empower you to grow your lending portfolio to support the success of small businesses.

Build standardized, flexible, and scalable processes that are configurable and easily updates to seamlessly integrate with your existing systems, data partners, and other data sources, ensuring an efficient and optimized lending process. Tailor your loan origination process to your institutions needs with customizable workflows and rules to align with your specific lending policies and procedures, ensuring consistency of outcome and unwavering compliance.

Whether you’re originating small business credit card applications, lines of credit, or traditional loans, build standardized, flexible, and scalable processes that easily integrate with your existing systems and ensure an efficient lending process.

How would a Zoot Solution empower you to maximize your Small Business Lending portfolio?