The Ever Changing Landscape

As the financial and retail landscape continues to evolve, and customer expectations shift, banks need to focus on developing effective customer engagement strategies to build loyalty, retention, and satisfaction. Delivering exceptional experiences throughout the customer journey is critical, and strong brands are built on top-notch customer experience moments.

Today’s banking customers seek personalized, omnichannel experiences and look for convenience in accessing a wide selection of products and services. However, regulatory requirements and security controls can introduce friction into the user experience, which customers have very little tolerance for. This leaves financial institutions and merchants with a difficult balancing act in navigating the landscape.

“Bankers’ top investment priority in 2023 is better integrating their stack of technology systems and platforms to get a better handle on data and to develop a more holistic view of the customer to enhance their experience. Reducing friction in the customer experience can in turn help financial services organizations better compete when attracting new quality consumers.1”

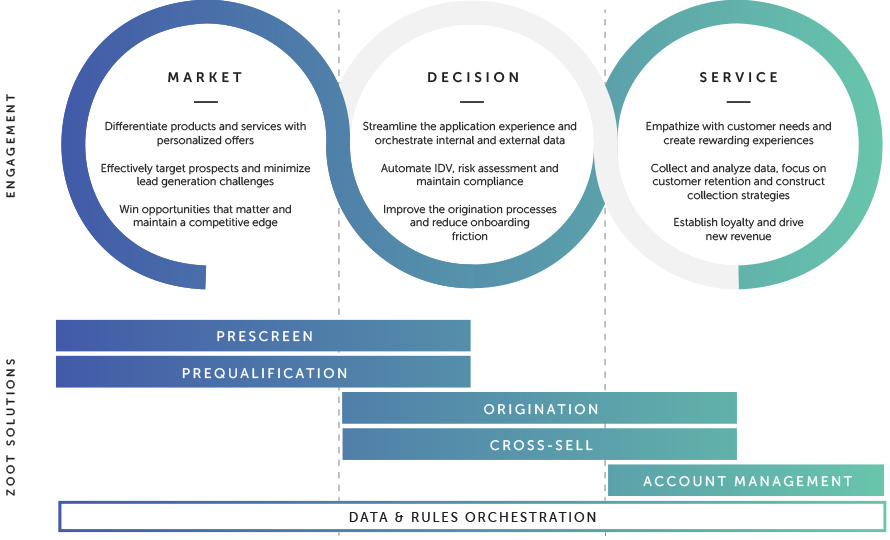

Providing rewarding experiences requires organizations to implement an effective customer engagement process, and robust management tactics. At the core of all of that is data. Collaborating with a leader who can quickly access data – the right data at the right time – is the key to differentiating an organizations products and services. Zoot Enterprises provides capabilities to orchestrate that data and logic into a strategy and decision engine, enabling organizations to grow their footprint, build trust, loyalty, and drive operational efficiencies.

What Makes for a Great Customer Experience

Successful organizations embrace customer expectations and adjust their services and products accordingly by employing a number of strategies. One effective approach is executing hybrid experiences, a customer journey that includes both digital and human interaction. The ease and effectiveness that comes from a digital experience, balanced with the reassurance of interacting with a real human, can increase positive emotions and build trust.

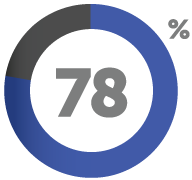

73% of all people point to customer experience as an important factor in their purchasing decisions. Yet only 49% of U.S. consumers say companies provide a good customer experience today.2

43% of all consumers would pay more for greater convenience; 42% would pay more for a friendly, welcoming experience. And, among U.S. customers, 65% find a positive experience with a brand to be more influential than great advertising.2

Zoot Enterprises is a leader in customer engagement strategies for banking, helping clients build trust and loyalty for over 30 years. Zoot’s proven technology is effective in adapting to customer needs through automation and enables human-to-human interaction at the account level. Whether a bank, retailer, or auto lender, Zoot’s tools and services provide organizations with quick access to the right data at the right time to make instant decisions and deliver satisfying customer experiences.

Zoot’s capabilities allow organizations to:

- Win opportunities that matter by getting product offers in front of prospects and existing customers the moment they are ready to make financial decisions.

- Effectively target existing customers and prospects with a complete, multi-sourced data set view of their financial activity, and maintain a competitive edge.

- Minimize lead generation challenges, build ideal customer profiles, and effectively connect with the people that will consume their products.

- Onboard more clients faster through an enjoyable application experience that automates identity verification, risk assessment, all while securing consumer data privacy.

- Cultivate a streamlined application experience, eliminate bad actors, and reduce onboarding friction.

Why the Customer Journey Matters

It has often been said that the most successful businesses have the most loyal customers. But in order to create brand affinity, businesses must first understand their customers and the journey they took to get to their website or physical location. The customer engagement journey provides a complete picture of a business’s operations, allowing decision-makers to continue making smart business development and customer care decisions.

Transforming customers into segments can help banks optimize their product portfolios and enable strategic decision-making across the enterprise. By leading with a customer-first mindset, segmentation can provide essential insights for sales and support teams and illuminate opportunities for improving the customer experience. Zoot’s robust decision engine supports multi-tenant segmentation, providing valuable insights and data required to establish a valuable connection with the customer.

“Companies look to transform customer segmentation. Segmentation is crucial to enable companies to target their marketing and customize their services. However, the traditional way of perceiving segments has changed, evolving to include more factors and layers.3”

For example, using data and insights to help customers understand whether they are in, or approaching, financial distress helps create an empathic position and demonstrates that you care about the customer and their wellbeing. Many times, financial institutions know this before a customer does, and by promoting debt consolidation loans to customers to help pay that off sooner can preserve relationship quality, maximize retention, and sustain or grow profits from your accounts. You want them to come back and buy from you again. Bottom line: treat customers with the highest level of personalization, empathy, and understanding at the beginning and end of the journey.

At the end of the day, companies are differentiated by empathy, emotion, and effectiveness in helping people. By understanding what drives a great experience and linking it back to what matters to the bank, such as loyalty, retention, share of wallet, and advocacy, banks can build strong customer engagement strategies. The customer engagement journey provides a complete picture of a bank’s operations, allowing decision-makers to continue making smart business development and customer care decisions.

Zoot has empowered clients to onboard an effective customer journey from marketing, through the complete credit lifecycle, and through to collection and recovery. Our tools and services help our clients to cut costs, maintain compliance, streamline origination processes, eliminate errors and speed up the decisioning process while providing prospects and current customers with rewarding experiences that drive customer engagement, trust, and loyalty.