Open banking can still be a bit controversial. Banks, fintechs, and other financial institutions (FIs) have typically had what you could call an “uneasy alliance.” In the US, many FIs have been reluctant to work with third-party fintech providers to access data due to security concerns surrounding data breaches and the risk of exposing sensitive consumer information.

Even so, the call for more access, connection and cooperation has grown, particularly after a long-awaited proposed rule from the Consumer Financial Protection Bureau (CFPB). Can the industry as a whole effectively answer the call?

What is Open Banking?

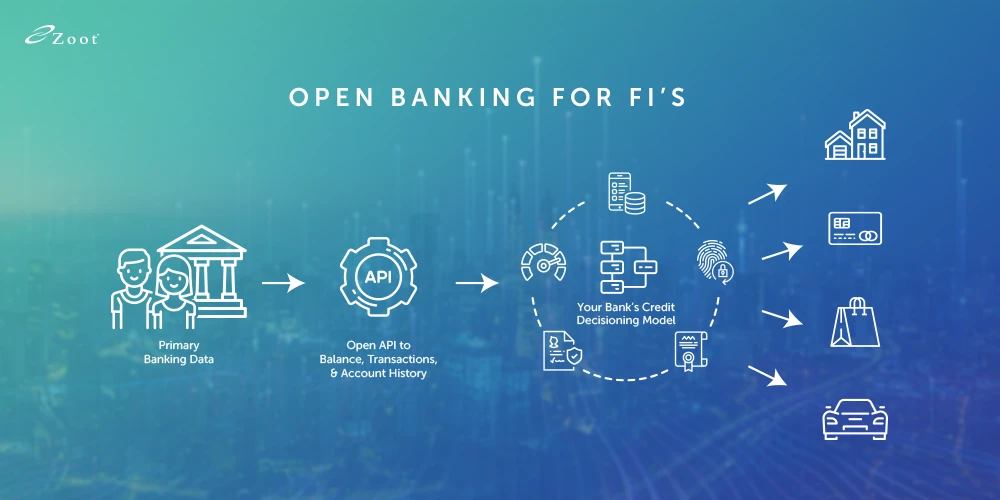

Open banking is a framework that uses open application programming interfaces (APIs) to facilitate secure data sharing and collaboration between traditional FIs and third-party service providers, allowing customers to consent to sharing account information, transaction history, and more. An open banking approach fosters innovation and competition, enhancing efficiency as well as the customer experience across the industry.

Throughout Europe and the UK, open banking has been mandated by “laws that explicitly require their banks to create [APIs] and open those…to third-party developers.” In October 2023, the CFPB proposed a Personal Financial Data Rights rule promoting seamless sharing of customer data among FIs, moving the US closer to an open banking system.

The proposed rule aims to give consumers more control over their personal financial data, enabling them to receive more favorable rates, link services, or switch banks more easily, among other benefits.

“Allowing consumers easy access and transferability of their financial data will improve consumer choice and competition and expand financial inclusion to those now shut out of mainstream credit products.”

Jason (Gross) Rosen

Founder & CEO of Prism Data, Former member of the CFPB Consumer Advisory Board

For FIs, this means operating in a new way. The push to standardize and publish APIs for secure, consumer-consent-based financial data sharing has continued to gain steam here in the US. Organizations like the Financial Data Exchange continue to establish ties and engage individuals from a number of stakeholder companies to determine how to best facilitate open banking.

There are also existing agreements between established entities and newer fintech companies, like the data exchange agreement between Wells Fargo and Envestnet Yodlee. These agreements are usually established by two specific organizations rather than broadly in the industry and rely on specific APIs rather than universal standards.

What’s the Difference Between Open Banking and Open Finance?

Open banking is limited to the sharing of financial information electronically, securely, and only with the consent of the account holder. On the other hand, open finance is a broader concept that extends beyond banking, facilitating greater access and integrations to a more comprehensive range of financial services such as investments, insurance, and more.

What Are the Benefits of Open Banking?

The benefits of open banking depend on who you are.

For consumers, the primary benefits are the ability to manage finances more easily through personalized budgeting tools, compare bank services, and integrate financial data. Consumer opinion is largely split along generational lines; a Deloitte survey found that 18- to 36-year-olds see much more value in open banking than those 37 and above. However, only 1/3 of all consumers are unwilling to allow their bank to share data, a number that has continued to shift in favor of open banking over the past few years.

For fintech providers, the benefits can be significant.

They can:

- More easily access consumer data, which banks have previously held.

- Streamline the implementation of their products and services.

- Quickly increase their potential customer base through partnership agreements with banks.

It’s a strong triple play for fintechs, helping explain their desire to truly open up banking services.

With open banking, FIs can build improved products and better manage risk. Data made accessible through open banking can provide greater insight into current and potential customers alike, allowing better and more highly-tailored products to be built to fit consumers’ exact needs. This kind of proactive personalization can also drive increased customer loyalty and mitigate attrition risks.

So, in theory, open banking could be win/win/win. As always, there is the potential for a few drawbacks.

What Are the Concerns with Open Banking?

The primary concerns surrounding open banking, whether from the consumer, fintech or traditional FI, focus on security and associated costs.

Consumers are most concerned with identity theft and misuse of data. Fintechs and FIs cite data security and customer privacy as their top areas of concern, followed closely by loss of control of customer data. All that personal financial information is an extremely attractive target, and companies are right to be concerned about the potential for breaches.

Some of the key questions that come up include:

- How vigorously do banks and third parties use security measures to monitor API’s and data?

- What controls are in place to enforce consumer decisions on how, when and by whom their data is accessed?

- How are financial institutions validating third parties to make sure rules are being followed

- What are the penalties for violations?

What is the Cost of Open Banking?

Feedback to the CFPB’s proposed rule has varied. Under the rule, larger FIs would be required to comply more quickly than their smaller counterparts, who will be reliant on intermediaries to facilitate the sharing of data. Large FIs are likely in a better financial position to enable open banking, though the actual cost of implementation has yet to be determined in most cases.

The Credit Union National Association (CUNA) drew attention to the cost division (if any). “CUNA is concerned about the cost of market failures if a rule develops that requires credit unions to give free access to its financial data or other proprietary intellectual property,” the comment reads. “In this particular instance, financial services providers invest significant resources in time, money, and continued upkeep for their databases, online access, and organized details about transactions. If third parties can access and use this data without paying their fair share, these third parties are free-riders.”

“Companies’ access to this financial data could put the burden of cost on banks and credit unions, without fintech companies paying their share.”

Another concern, though much less prominent on the radar of banking and fintech executives, is the potential to get left behind as competitors establish connections and data-sharing agreements with fintechs and other service providers.

Is There a Better Way?

While the full benefits and drawbacks of open banking remain to be seen, there are ways financial institutions can approach it without having to throw their data out into the wild. One model that works today – and works well – is to partner with an organization that allows your bank to centralize all of its connections to other organizations.

This “hub and spoke” model can provide a blend that gives traditional banks and their customers the best of all worlds. Using a third party to build, manage and maintain API connections can free up organizational resources while still providing access to the products and services that your institution and your customers want. And with the right partner, your company still maintains complete control over your internal data and has no need to share or expose it to other companies.

That partner will have a few things in place that can work to your advantage:

- Existing connections that can be quickly and easily integrated into existing services.

- A wide range of pre-built connections that can help identify the right products and services for your customer base.

- The ability to launch those connections immediately, enabling you to beat competitors to market and meet customer demands.

For the last 30 years, that partner has been Zoot Enterprises for many of the largest banks in the country. If you’re thinking about taking a step forward, let’s talk. We can help you make the connections you need with our nimble, powerful solutions while keeping you and your data safe and secure.

What steps will your organization be taking to embrace the open banking environment in 2024?