Advanced Decision Management

Optimize Your

Decision Making

Revolutionize your organization’s decision-making capabilities with advanced decision management solutions that capitalize on the power of data, streamlining workflows, and replacing manual assessments with advanced solutions, ultimately elevating your business’s operational efficiency and driving success.

Fuel Decisions with Data

Execute logic based on your criteria utilizing both internal & external data within the same workflow.

Thorough & Accurate Testing

Ensure the accuracy of each individual decision via thorough testing by Zoot and your own internal teams.

Replace Manual Assessments

Increase efficiency by replacing manual assessments with powerful, streamlined automated workflows.

Overview & Key Benefits

Don’t get caught in an endless cycle of inefficient and inaccurate decision making. Speed up your most complex decisions, streamline testing, and go to market faster with Zoot advanced decision management tools.

Our solutions automate real-time, analytics-based decision making, improving your decision quality and accuracy while maintaining regulatory compliance through documented, traceable decisions. Regardless of their complexity, all processes, workflows, and logic live within the same platform to increase efficiency and cost savings.

With Zoot, evaluate all data points and execute logic based on your unique, predetermined criteria and negate the need for lengthy manual review with our fully customizable advanced decision management models.

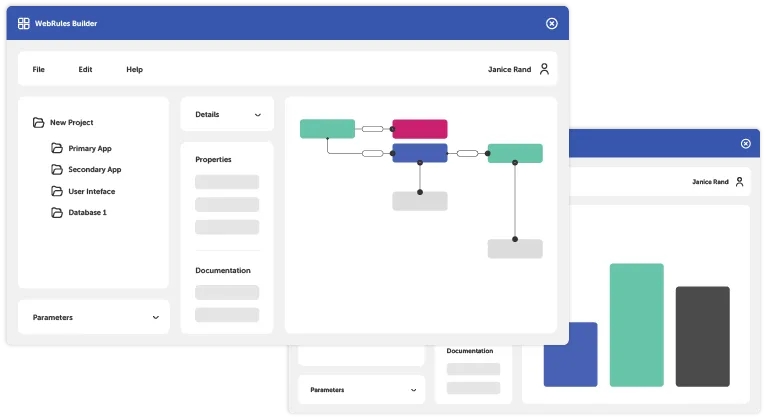

How It Works

Our low-code environment puts the power back in the hands of businesspeople and developers alike, allowing you to test your decision models to generate the most favorable outcomes.

Instant Decisioning

Make Instant, Accurate Decisions

Elevate your organization’s advanced decision management capabilities with Zoot’s expertise in creating powerful decision flows, scorecards, strategy tables, and more. By leveraging proven models, you’ll rapidly assess risk, profitability, and other critical factors, enabling objective decision-making driven by consistent policies.

With Zoot’s intuitive tools, streamline the development and adjustment of custom test files for an automated testing process. This approach accelerates anomaly detection and reduces time to revenue, ultimately enhancing your overall advanced decision management strategy.

Connect to New & Existing Data

Utilize Zoot’s secure API to combine your own data with powerful insights from our data partners to orchestrate the best combination for your decision process. By leveraging Zoot’s API, you can streamline your decision-making processes, target ideal customers, and access the right data at the right time to enhance your customer lifecycle

![]()

“Zoot can take most applications through without people having to touch them. And that can make a big difference in the number of people and costs for that application process.”

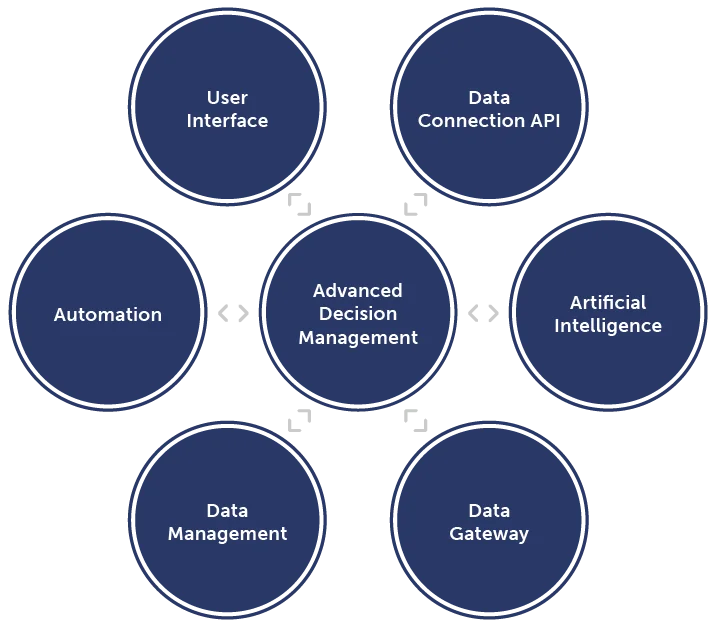

Zoot Capabilities

Zoot’s capabilities work together to form the foundation of your solution, combining your data with data from our partners to optimize processes and decision outcomes across your organization.

In addition to its data-driven capabilities, Zoot offers a seamless user experience that empowers your organization to stay ahead in a rapidly evolving market.

With its intuitive interface and customizable features, Zoot allows you to effortlessly navigate through complex data sets, uncover insights, and make informed decisions. Whether you’re a small startup or a multinational corporation, Zoot’s scalable platform ensures that your organization can adapt and grow with ease.

Ready to Take the First Step?

Your journey to success starts here. Fill out the simple form below to get personalized advice, insights, and solutions tailored to your unique needs. It’s quick, it’s easy, and it’s the first step towards achieving your goals.

Additional Resources

The Rising Tide: Understanding the State of Application Fraud in the U.S.

Application fraud, once considered a sporadic issue, is now a fast-moving, ever-evolving threat. In 2025, it’s not just about a few bad...

Key Takeaways: Finovate Spring 2025

Zoot was proud to join the fintech and banking community at Finovate Spring 2025, where the theme of modernization took center stage....

Key Takeaways: Financial Brand Forum 2025

Financial Brand Forum 2025 brought together thousands of financial services leaders in Las Vegas for three packed days of conversation,...